Claiming tax relief on food

Posted on 26th February 2024

When does food you buy for yourself when you’re working become an allowable business expense?

There are separate rules for entertainment costs. For everyday food and drink, the simplest answer is that you can claim when you’re travelling on business.

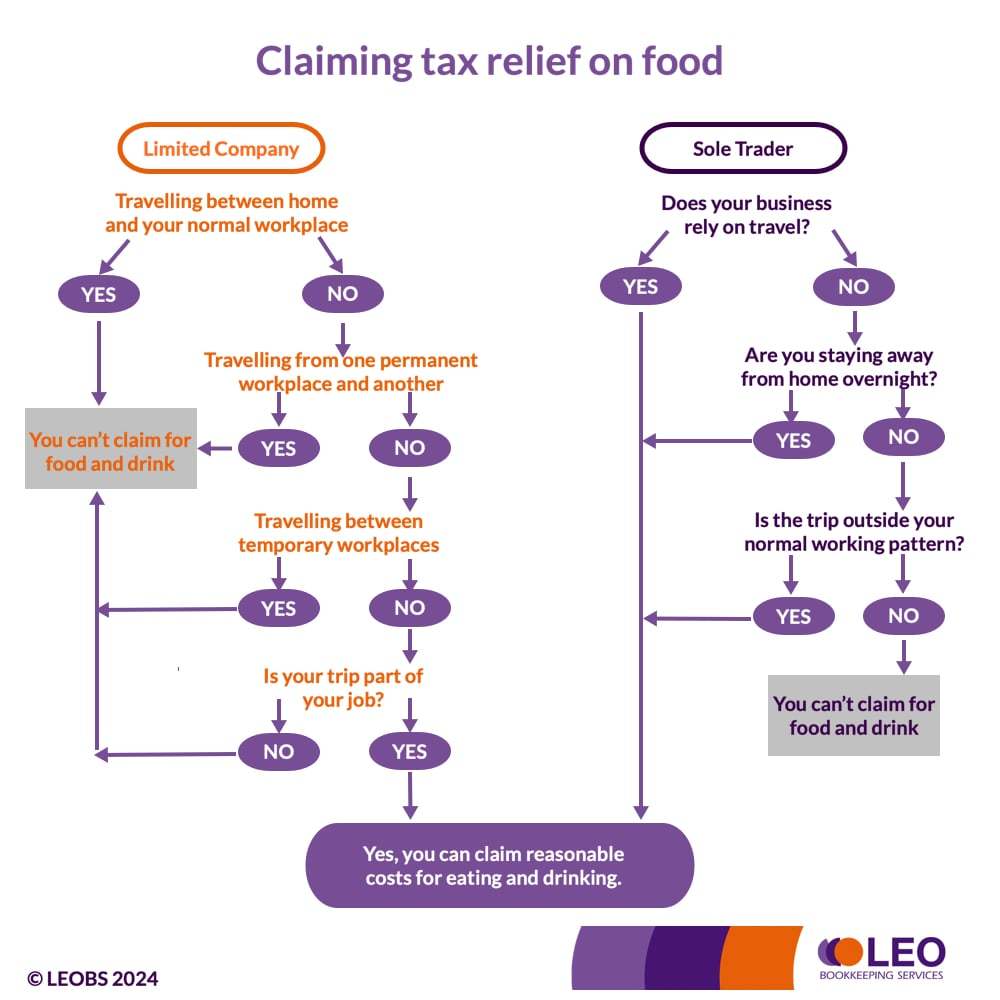

However, that’s not really simple at all. The rules are different if you’re self-employed or an employee, even if you work for your own limited company. To help explain, we’ve made a flowchart.

Tax relief on food for sole traders

If you’re a sole trader you can claim ‘reasonable costs’ of food and drink when you’re travelling for business. This applies if:

your business requires you to travel, for example, as a travelling entertainer

you make occasional business journeys outside the normal pattern, such as a home-based writer travelling to meet a publisher

you stay overnight on a business trip and claim the cost of accommodation and meals. This also applies if you’re a long-distance HGV driver and you sleep in your cab overnight.

HMRC doesn’t define a ‘reasonable cost’ but rules out ‘elaborate meals with fine wines’.

Tax relief on food for employees

As an employee you can’t claim for food and drink when you’re travelling to and from your workplace, even if the location is temporary. However, you can normally claim from your company for the cost of meals when you’re travelling for business. This is an allowable expense.

As a general rule, if you can claim the cost of the travel, you can also claim the cost of a meal. HMRC includes this as ‘the necessary cost of business travel’. The journey doesn’t need to include an overnight stay or be outside your normal patterns of business travel.

Share this post: